How Much Does a Lawyer Charge to Transfer a Deed? Considerably Less Than the Potential Cost of Mistakes. Mistakes in deed transfers can be more than just costly; they can derail the entire transaction. As experienced deed transfer attorneys, Latoison Law prioritizes accuracy, thoroughness, and legal compliance in every transaction. Let us manage the legal intricacies of your deed transfer. For meticulous and reliable legal services, call us at (610) 999-1439.

On this page

Introduction to Property Deed Transfers

Property deed transfers are a fundamental aspect of real estate transactions, serving as the official record of ownership change. In Pennsylvania, the importance of a deed transfer cannot be overstated—it not only documents the transfer of property rights but also ensures that all legal requirements are met to validate the change in ownership. A deed, in its essence, is a legal instrument that, when executed correctly, provides a new owner with the title to real estate, effectively transferring the rights, titles, and interests in the property from the seller to the buyer.

Types of Deeds Relevant to Pennsylvania

In Pennsylvania, various types of deeds are used to transfer property, each serving different purposes and offering different levels of warranty:

- General Warranty Deed: Offers the highest level of buyer protection, including a full warranty of clear title against all claims.

- Special Warranty Deed: Provides a limited warranty, covering only the period during which the seller owned the property.

- Quitclaim Deed: Offers no warranties regarding the title’s quality, transferring only the interest the seller has at the time of the transfer, if any.

Understanding the distinctions between these deeds is crucial for both buyers and sellers to ensure their rights are adequately protected during the transfer process.

Understanding the Transfer Process

The deed transfer process in Pennsylvania involves several critical steps, including:

- Preparation of the deed document, accurately reflecting the transfer details.

- Ensuring all parties correctly sign the deed, adhering to state-specific requirements.

- Paying applicable transfer taxes and fees.

- Recording the deed with the local county recorder’s office to make the transfer public record.

This process requires careful attention to detail and adherence to legal standards to ensure the transfer is valid and enforceable.

Cost Factors in Deed Transfers

Several factors influence the cost of transferring a deed in Pennsylvania, including:

Recording Fees

Recording fees are charged by local county offices to file the deed, making the transfer part of the public record. These fees can vary significantly from one county to another, affecting the overall cost of the transfer.

Transfer Taxes

Pennsylvania imposes a state transfer tax on property transactions, with the possibility of additional local taxes depending on the property’s location. The tax rate can vary, and certain transactions may qualify for exemptions or reduced rates, emphasizing the importance of understanding these nuances.

Additional Costs

Other expenses may include title searches, necessary to confirm the property’s clear title, and title insurance, protecting against future claims. These costs contribute to the overall financial implications of transferring a property deed.

How Much Does A Lawyer Charge to Transfer a Deed

When it comes to determining how much a lawyer charges to transfer a deed in Pennsylvania, the answer is not one-size-fits-all. Attorney fees can vary widely based on several factors, including the complexity of the property transfer, the type of deed being used, and the level of expertise and services provided by the attorney. However, to give prospective clients an idea, we can outline a general framework for understanding these costs.

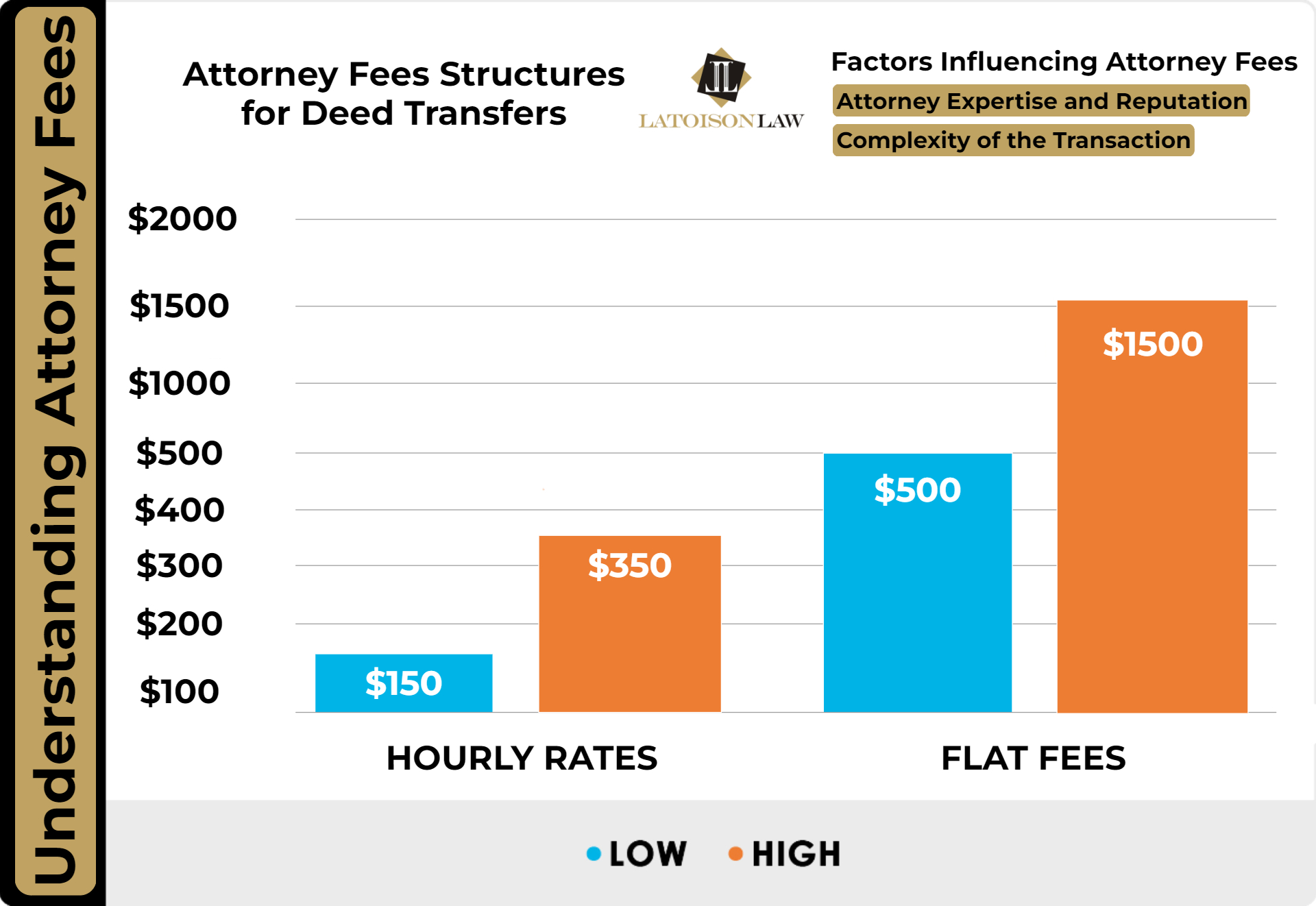

Factors Influencing Attorney Fees

Complexity of the Transaction: Simple transactions, such as a straightforward transfer between family members using a quitclaim deed, may require less legal work and therefore incur lower fees. In contrast, transfers involving a general warranty deed, which requires extensive title searches and guarantees, may be more expensive due to the additional work and risk management involved.

Attorney Expertise and Reputation: Attorneys with a specialized focus in real estate law or those with a significant reputation in the field may charge higher fees. Their expertise, however, can provide invaluable in navigating complex legal issues and ensuring the transfer complies with all Pennsylvania laws.

Additional Services: Some transfers may require additional legal services, such as negotiating terms with other parties, addressing title issues, or managing the closing process. These services will add to the overall cost.

Typical Fee Structures

Flat Fees: Many attorneys offer flat-rate fees for standard deed transfers, providing clients with a clear understanding of costs upfront. These fees can range from $500 to $1,500, depending on the transaction’s complexity and the services included.

Hourly Rates: For more complex transactions, attorneys may charge an hourly rate, ranging from $150 to $350 per hour or more, based on their experience and the transaction’s demands.

Additional Costs: It’s also important to consider other potential costs, such as title searches, title insurance, and filing fees, which may not be included in the attorney’s fees but are essential to the transaction.

Flat Rate Prices vs. Hourly Rate: Choosing the Best Option for Deed Transfers

When engaging a lawyer for a deed transfer in Pennsylvania, understanding the difference between flat rate prices and hourly rates is crucial in making an informed decision. Each fee structure has its advantages and considerations, depending on the transaction’s specifics and the client’s needs.

Flat Rate Prices

Advantages:

- Predictability: Flat rates offer a clear, upfront cost, making budgeting for legal expenses straightforward. Clients appreciate knowing the total cost from the outset, without surprises.

- Simplicity: This fee structure is typically used for more straightforward transactions, where the scope of work is well-defined and predictable. It simplifies the billing process for both the client and the attorney.

- Efficiency: Flat rates can incentivize attorneys to work efficiently, as the fee does not change based on the number of hours worked.

Considerations:

- Scope of Work: Before agreeing to a flat rate, it’s essential to clearly understand what services are included. Some matters that become more complex than initially anticipated may incur additional charges.

- Cost-Effectiveness: For very simple transactions, a flat rate might actually be higher than the equivalent cost at an hourly rate, given the minimal amount of work required.

Hourly Rates

Advantages:

- Flexibility: Hourly billing is adaptable to the unpredictable nature of more complex transactions. As new issues arise, the billing can accommodate the additional work without needing to renegotiate the fee arrangement.

- Transparency: Clients receive detailed billing statements, outlining how their attorney’s time was spent. This can provide insight into the process and the work being done on their behalf.

Considerations:

- Uncertainty in Costs: The major downside is unpredictability. It can be challenging to estimate the total cost upfront, as it depends on the number of hours worked.

- Monitoring Costs: Clients may need to more actively manage and monitor their legal expenses to ensure they align with their budget and expectations.

Making the Choice

The decision between a flat rate and hourly billing often comes down to the transaction’s complexity and the client’s preference for cost predictability. For straightforward deed transfers, a flat rate may be more appealing, offering a simple, predictable fee structure. Conversely, for transactions that involve more complex negotiations or unforeseen legal challenges, an hourly rate might provide the necessary flexibility to address issues as they arise.

Ultimately, the best approach to determining how much a lawyer will charge for a deed transfer in Pennsylvania is to consult directly with a real estate attorney. They can provide a more accurate estimate based on the specifics of your transaction. Firms like Latoison Law are equipped to assess your situation, explain potential costs, and offer guidance tailored to your needs, ensuring transparency and fairness in pricing.

The Importance of Legal Guidance

Navigating the intricacies of property deed transfers in Pennsylvania emphasizes the value of professional legal guidance. An experienced attorney can provide critical insights into minimizing costs, ensuring compliance with state and local regulations, and addressing any legal issues that may arise during the process. Law firms like Latoison Law offer the expertise necessary to navigate these complex waters, ensuring that clients understand their obligations and options, thereby facilitating a smoother transfer process.

For individuals and entities involved in property transactions in Pennsylvania, understanding these factors and seeking appropriate legal counsel can make the difference between a seamless transfer and one fraught with complications and unforeseen costs. Engaging a knowledgeable attorney early in the process can provide peace of mind and protect the interests of all parties involved.